Part 4: The Big Canadian Short

The Canadian government is desperately trying to contain the housing boom and prevent the start of a financial collapse, but it’s nearly impossible to stop the market from doing what it does. When money is cheap—meaning, when interest rates are low—borrowing becomes easier and adding leverage becomes easier. When becoming highly leveraged is fashionable, firms are tempted to start “picking up pennies in front of a steamroller.” That was the case with Home Capital Group, and it’s not the only lender getting dangerously close to that steamroller.

Of course, investors have been calling a market top since at least 2012, and they’ve been wrong every time. Hot markets can be unaffordable, but they aren’t unsustainable as long as there is more demand to swallow up the supply. Canadian markets have consistently had plenty of demand.

But when this demand comes from highly leveraged sources, as it appears to right now, it can reverse quickly—and violently. We don’t know exactly when that will happen, but it will happen eventually, and Canada might have too much debt to absorb the next crisis.

So, if the Canadian housing market looks like it might start to turn (keeping in mind that investors have been wrong about that since at least 2012), there must be some way to profit from the fall.

By now, almost everyone is familiar with The Big Short, the famous story of the hedge fund managers who bought derivatives, known as credit default swaps, which essentially worked as insurance designed to make huge payouts if homebuyers began defaulting on their mortgages. It was a low risk, high reward bet, and they won the reward.

That might sound like an attractive way to bet against the Canadian housing market, but it’s a complicated transaction that is only available to a small number of people with significant assets and good connections. There are better options.

Let’s focus on something more accessible.

When real estate markets begin to implode, there are a few major investments that go down with it, including homebuilders, REITS, and mortgage lenders.

The most direct way to bet against housing markets is by looking at the homebuilders and the REITs. Unfortunately, there aren’t any great options to bet against in these industries. The major homebuilders in Canada are either privately held or small parts of huge companies, and the REITs are too diversified to make a secure downside bet.

That leaves the mortgage lenders.

But there are two factors that make this approach risky as well: Which lenders do you short? And what about timing?

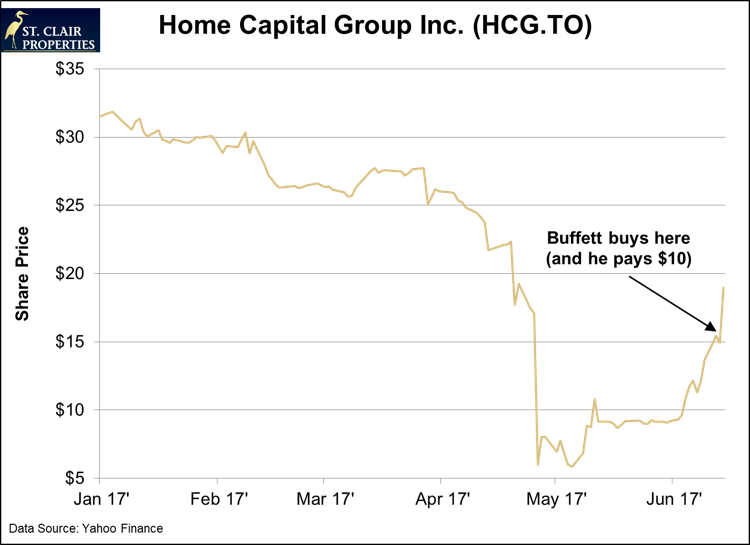

The short sellers who chose Home Capital Group made a killing, but that’s only if they made the trade within the past two years. From 2012 to 2015, it wouldn’t have worked, and now it’s likely that most of the downside was already collected, because Warren Buffett has just agreed to bail the company out (at a very steep cost to the company—Buffett is replacing the old bailout funds with a new C$2 billion line of credit at 9.5% interest and buying 38.4% of the company at $10 per share). The stock rose 27% on the day the deal was announced.

The other lenders are not any more attractive. There is already more than US$13 billion in short bets against Canada’s banks, making it a crowded trade, and Canada’s biggest banks are maintaining reasonable balance sheets and strict lending standards. That doesn’t mean they won’t suffer when the market turns; it just means that the potential profit from short-selling might not make up for the risk of being on the wrong side of the trade for a few years. It’s extremely difficult to hold on to a short sale even if it’s guaranteed to eventually be right.

So what can an investor do?

For most investors interested in Canada’s real estate markets, the best move is to avoid it. Hold on to the cash and wait for a crash; about a year after the crash, after everyone else gets wiped out trying to sell their properties, that will be the time to start buying. That’s pretty similar to what Warren Buffett did, and he made more than 80% on the first day of his bailout deal. We can’t expect that kind of return, but we can say that it’s much easier to wait and buy than to bet on the downside.