Part One: A Primer on Leverage

One of the largest factors for real estate investing—if not the largest factor—is the impact of leverage. Leverage is basically the idea that some portion of the investment is financed with borrowed money. Over time, real estate properties lag the performance of stock investments; the additional leverage is what makes up the difference.

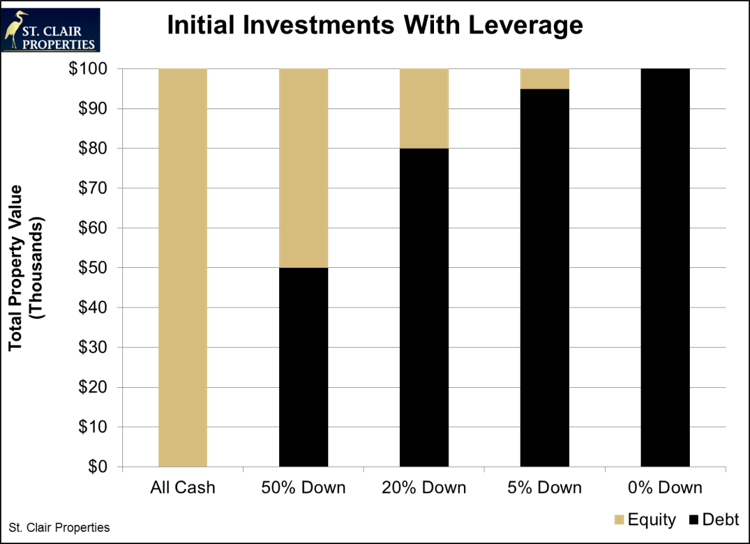

Leverage can offer an exceptional boost for real estate returns. To prove this point, we explore a very simple model that shows the difference between a set of five investments with a range of debt financing:

- All cash (no leverage)

- 50% down, just for comparison

- 20% down, the most commonly recommended down payment

- 5% down, a common down payment for first time homebuyers

- 0% down, a risky loan that is only available in unique situations

Assuming a $100,000 property, here’s how they stack up in the initial investment:

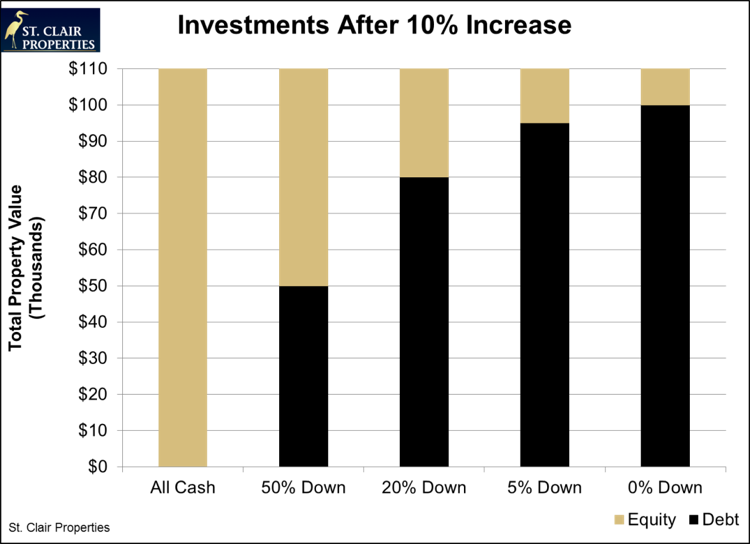

For this model, we’re ignoring the more advanced parts of real estate investing that involve cash flows and amortization. What we’re interested in here is just to show how using leverage affects the returns on the initial investment. To make the comparison as simple as possible, we assume that the $100,000 property rises in value by $10,000, or 10%. This adds $10,000 to the equity portion of the investment, but doesn’t affect the debt. Here’s how it changes the returns:

In all cases, the total property value went up by 10%, and each equity bar expanded by $10,000, but the investor’s rate of return was much different. A 10% jump in value will provide a better return for an investment with more leverage. Here’s what the returns look like for each level of down payment:

- All cash: 10%

- 50% down: 20%

- 20% down: 50%

- 5% down: 200%

- 0% down: (infinity)

A 20% down payment can bump a 10% increase into a 50% return. That’s the power of leverage!

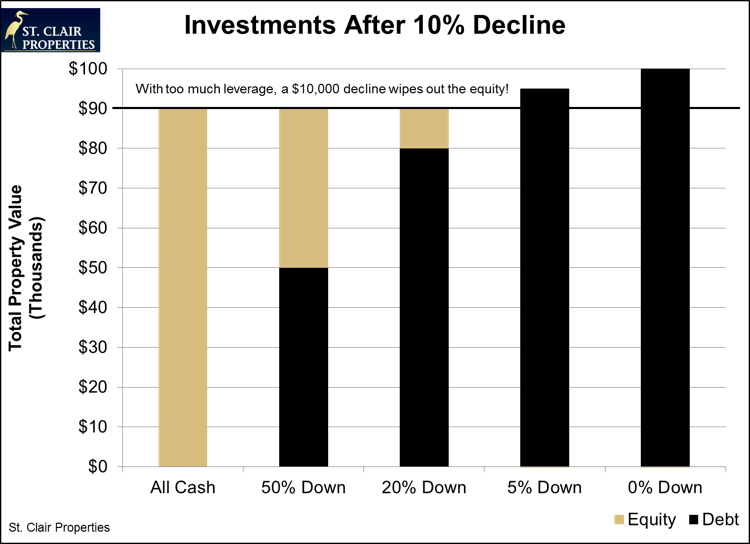

But it works the other way, too. Let’s take our $100,000 property and drop its value by $10,000, or 10%. The stacked bar charts that we’re using don’t properly show the impact of negative numbers, so we’re adding a bold line at the new $90,000 value to demonstrate how much extra debt will need to be repaid.

Any decline in value will put an investment with no equity underwater, and a drop of the magnitude that we’ve chosen will also wipe out the 5% down payment’s equity. When translated into a return on investment, it mirrors the 10% upswing:

- All cash: -10%

- 50% down: -20%

- 20% down: -50%

- 5% down: -200%

- 0% down: (negative infinity)

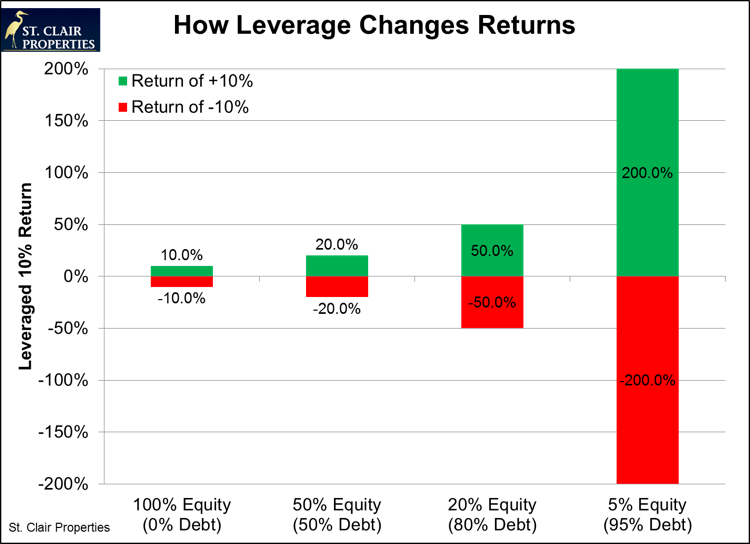

There’s a very clear connection to the amount of leverage and how much returns are amplified. We can show what this looks like on a graph.

There are many other ways to describe this relationship, and it leaves out a few variables, such as the cash flows generated from renting, but the simple fact is that a more leveraged investment will produce a magnified return on both the upside and the downside.

This is a pretty straightforward explanation, but it actually understates the danger of having too much leverage—when the equity gets too far into the negative, the lenders will get nervous, and exiting the investment may lead to even further losses (if it’s even still possible to get out).

The rental income from the property will often continue to cover its debt payments, but it might not. If it doesn’t, then the investor’s losses also become the lender’s losses. If the lender made too many high-leverage loans, it could end up facing a bankruptcy or looking at a bailout. If the entire banking system is drunk on excess leverage, then the whole thing could collapse; it only takes one major bank failure to signal a future crisis.